Main content:

Zinc manganese battery is the most common batteries in daily life and belong to international standardized products. Like 18650 battery, the zinc manganese battery has a simple structure, a long storage time, is easy to carry, is less affected by external humidity, temperature and other environments, and has stable and reliable performance.

1. Zinc manganese battery types and comparison

The zinc manganese battery is a primary battery that uses manganese dioxide as the cathode and zinc as the anode to generate current through redox reactions. It is widely used in various life scenes. The common models are number 5 and number 7 batteries.

Compared with other primary batteries, zinc manganese battery has the advantages of high power, good discharge performance, high battery capacity, and long storage life. According to different electrolytes and electrode structures, zinc manganese battery can be divided into carbon zinc manganese battery and alkaline zinc manganese battery.

Comparison of carbon and alkaline zinc manganese batteries

|

Carbon zinc manganese battery |

Alkaline zinc manganese battery |

|

|

Cathode |

Conductive carbon rod |

MnO2 |

|

Anode |

Zinc shell |

Zinc powder |

|

Electrolyte |

Zinc chloride, ammonium chloride |

KOH |

|

Battery capacity |

- |

3-7 times of carbon manganese battery |

|

Discharging time |

- |

3-7 times of carbon manganese battery |

|

Low temperature performance |

Weaker |

Better |

|

Environmental Pollution |

Contains a small amount of metal cadmium, which has certain pollution and needs professional recycling |

No heavy metal pollution |

|

Application fields |

Home appliance remote controls, flashlights, toys and semiconductor radios, clocks, electronic scales and other small household electronic equipment |

Digital products, intelligent household products, wireless security equipment, outdoor electronic products, medical electronic equipment, electric toys, etc. |

|

Main application country |

Developing countries and some regions with backward economic development |

Europe, America, Japan and other developed regions |

2. Zinc manganese battery industry chain

From the perspective of the zinc manganese battery industry chain, the upstream is raw materials, mainly including manganese powder, zinc powder, zinc cylinder, carbon rod, steel shell, copper needle, etc. The midstream includes the manufacture of alkaline zinc manganese battery and carbon zinc manganese battery. Downstream of the industrial chain are electric toys, household appliances, smart home, household medical equipment, outdoor electronic equipment and other application fields.

Zinc manganese battery industry chain

|

Upstream |

Midstream |

Downstream |

|

Manganese powder Zinc powder, zinc cylinder Separator paper Carbon rod, steel shell Copper needle |

Alkaline zinc manganese battery Carbon zinc manganese battery |

Electric toys Household appliances Smart home Home medical equipment Outdoor battery equipment |

From the perspective of upstream raw materials in the industrial chain, the main raw materials for zinc manganese battery is processed from some non-ferrous metals (copper, zinc). According to statistics, in 2021, China's nonferrous metals industry will overcome the negative impact of repeated epidemics, grasp the opportunities of recovery in the Chinese and international markets, and the overall operation of the industry will be stable.

3. Analysis of current situation of zinc manganese battery industry

Global

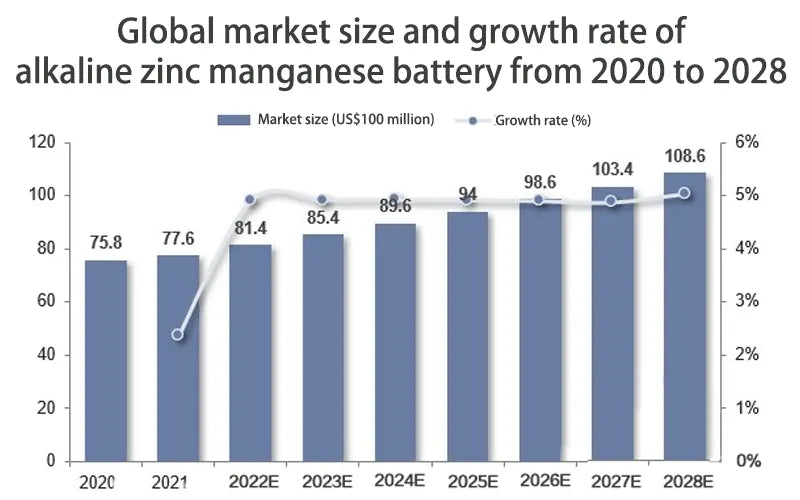

From the perspective of the global alkaline manganese battery market size, according to statistics, due to the impact of the new crown epidemic, the import and export of alkaline manganese batteries will decrease in 2020-2021, and the growth of the market scale will be hindered.

In 2021, the global alkaline manganese battery market size will be US$7.76 billion, a year-on-year increase of 1.3%. As the impact of the epidemic gradually weakens, the growth rate of the global lithium vs alkaline batteries market will return to normal levels. It is estimated that the global alkaline manganese battery market will reach US$10.86 billion in 2028, with a compound growth rate of 4.9% from 2021 to 2028.

China

With the development of China's zinc-manganese industry, internationally renowned brand companies have gradually withdrawn from the production process due to the impact of high local labor and raw material costs. China has become the world's largest zinc manganese battery production base.

Zinc manganese batteries, lithium primary batteries, and storage batteries are all primary batteries. According to statistics, the output of primary batteries and battery packs in China will reach 41.12 billion in 2021, a year-on-year increase of 0.7%. It is estimated that the output of primary batteries and primary battery packs in China will exceed 42 billion in 2024.

In terms of import and export, China's alkaline manganese batteries are mainly exported. According to statistics, China will export 14.51 billion alkaline zinc manganese battery in 2021, a year-on-year increase of 10.2%, and the export value exceeds US$1.3 billion, a year-on-year increase of 9.4%.

4. Future development trend of zinc manganese battery industry

Compared carbon zinc battery vs alkaline, the counter electrode structure of alkaline zinc manganese battery increases the relative area between the cathode and anode of the battery. The battery capacity and discharge time of the alkaline manganese battery are 3-7 times that of the same type of carbon manganese battery. In terms of operating temperature, alkaline manganese batteries are more resistant to low temperatures, and are more suitable for high-current discharge and stable operating voltage scenarios.

In addition, the alkaline manganese battery is mercury-free, cadmium-free, lead-free, green and environmentally friendly, and will not cause heavy metal pollution to the environment. In 2021, China will export 14.505/14.499 billion alkaline zinc manganese battery and carbon zinc manganese battery respectively. The proportion of alkaline zinc manganese battery in the export structure of zinc-manganese batteries continues to increase, and carbon-manganese batteries will gradually be replaced by alkaline-manganese batteries in the future.

The electric toy market grew moderately, and the demand for zinc manganese battery was stable. Toys are divided into non-powered toys and electric toys according to different powers. Among them, electric toys are very popular among children because of their sports and controllable functions. According to PND data, the global toy market sales will reach US$104.2 billion in 2021, a year-on-year increase of 9.7%, and sales will hit a record high.

In terms of the Chinese market, according to data from the China Toy and Baby Products Association, the sales of the Chinese toy market will reach 85.46 billion RMB in 2021, a year-on-year increase of 9.6%. It is expected that the retail sales will reach 91.4 billion RMB in 2022. The global and Chinese toy market as a whole showed a moderate growth trend.

The update and iteration of home appliances has brought about incremental demand for zinc manganese battery. Zinc manganese battery is an important part of home appliances. The release of demand for home appliances will further promote the increase in zinc manganese battery. Secondly, the upgrading of the product structure of home appliances, especially the requirements for environmental protection, can promote the development of alkaline zinc manganese battery with higher environmental protection and performance requirements.

According to statistics, in 2021, the cumulative sales of all categories of China's home appliance industry will be 760.3 billion RMB, a year-on-year increase of 3.48%, and the CAGR during 2012-2021 will be 2.8%. Due to the slowdown of global economic growth and the decline of residents' consumption capacity, the home appliance industry has experienced significant shocks. However, intelligent, customized, updated, and environmentally friendly home appliances have gradually become consumption trends, and the demand for product updates and iterations has accelerated.

Aging promotes household medical care, and zinc manganese battery market space expands. With the acceleration of the aging trend, and the improvement of per capita income and consumption levels, people's awareness of health management has increased, and family health management has received more attention, which will further stimulate the demand for household medical equipment.

According to statistics, from 2015 to 2020, the scale of my country's home medical equipment market increased from 48 billion RMB to 152.1 billion RMB. From 2015 to 2019, the proportions of all medical equipment were 15.58%, 16.22%, 16.95%, 17.87%, 20.50%. It is estimated that the home medical equipment market is expected to reach 350 billion RMB in 2025. The continuous growth of the downstream home medical equipment market has also increased the continuous demand for zinc manganese battery.

Related articles: nicd vs nimh battery, agm vs lead acid