Main content:

Lithium battery materials are mainly divided into four key materials and auxiliary materials such as conductive agent, dispersant, binder, copper foil/aluminum foil. The four key materials are composed of cathode, anode, electrolyte and separator. Among them, the cathode material is the core material of the best lithium batteries, which determines the core performance of the battery in terms of energy density, voltage, service life and safety, and is also the most expensive part of the lithium battery material cost. It accounts for about 40% of the total cost of lithium battery cells, and is one of the most important links in the lithium battery industry chain.

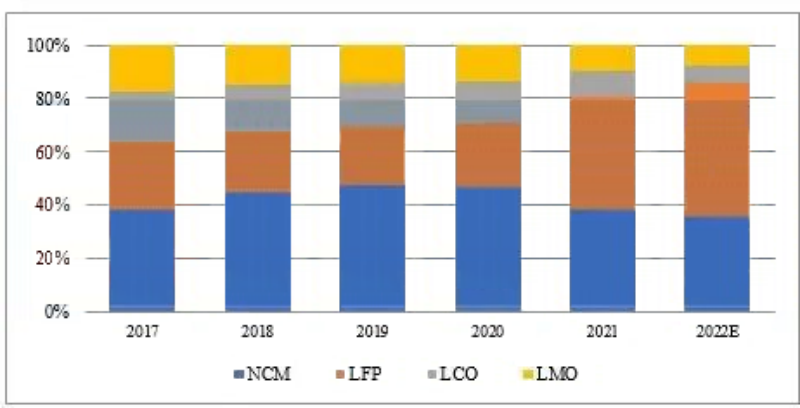

The cathode materials are mainly divided into lithium cobalt oxide (LCO), ternary materials (NCM, NCA), lithium iron phosphate (LFP) and lithium manganate (LMO). Depending on the material properties, their application areas are also different. Lithium cobalt oxide materials are mainly used in digital fields such as mobile phones and notebooks because of their high energy density and fast charging; ternary materials are mainly used in new energy vehicles and a few digital fields; lithium iron phosphate is mainly used in new energy vehicles and energy storage fields; lithium manganate materials are mainly used in low-end digital, lithium-ion bicycles and a few low-cost commercial vehicles.

Shipment and forecast of cathode materials in China from 2017 to 2025 (unit: 10,000 tons)

The data shows that, thanks to the strong growth of the terminal market and the increase in overseas exports, China's cathode material market as a whole has shown a rapid growth trend. In 2021, China's cathode material market shipments will be 1.13 million tons, a year-on-year increase of 116%. Among them, the shipment of lithium iron phosphate cathode materials was 480,000 tons, a year-on-year increase of 258%; the shipment of ternary cathode materials was 430,000 tons, an increase of 80% year-on-year; the shipment of lithium cobalt oxide cathode materials was 106,000 tons, a year-on-year increase of 31%; the shipment of lithium manganate cathode material was 109,000 tons, a year-on-year increase of 60%. It is predicted that by 2025, China's cathode material shipments will reach 4.71 million tons, and the market has great room for growth.

1.Ternary material

Ternary materials refer to composite cathode materials made of nickel salts, cobalt salts, and manganese salts combined with lithium salt compounds through a certain sintering process. According to the different content ratios of the three elements, different types of ternary materials can be matched. At present, the mainstream products in the Chinese market mainly include the 5-series, 6-series and 8-series. Due to the advantages of high energy density and stable electrochemical performance, ternary materials are widely used in batteries for new energy vehicles, lithium-ion light vehicles (including shared motorcycles), and power tools.

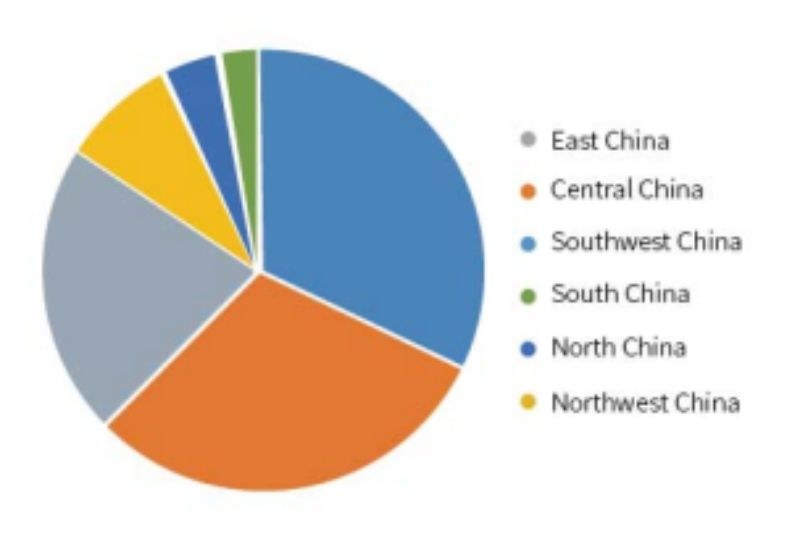

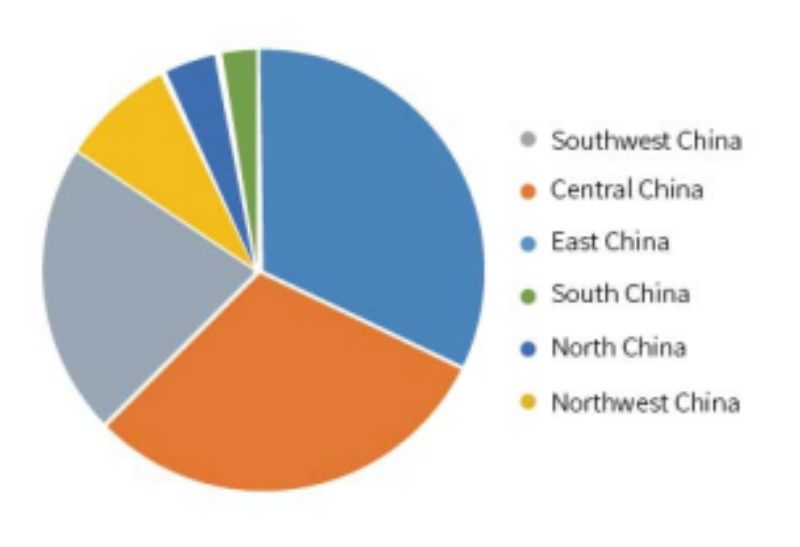

From the perspective of regional layout, China's ternary cathode material production capacity is mainly concentrated in East China, Central China and Southwest China, and the total production capacity accounts for more than 80% of the total production capacity. Among them, East China mainly benefits from the concentration of power battery production capacity, ternary cathode material companies build factories close to customers, and Central China and Southwest China mainly benefit from mineral resource endowment and factor cost advantages, attracting a number of outstanding companies to land and put into production. South China mainly contributes to the production capacity of Guangdong Province, while the production capacity of ternary cathode materials in North China and Northwest China is relatively low.

Regional distribution of production capacity of ternary cathode materials in China in 2021 (unit: %)

Note: There is currently no production capacity of cathode materials in Northeast China, and Taiwan Province is not included in East China, the same below

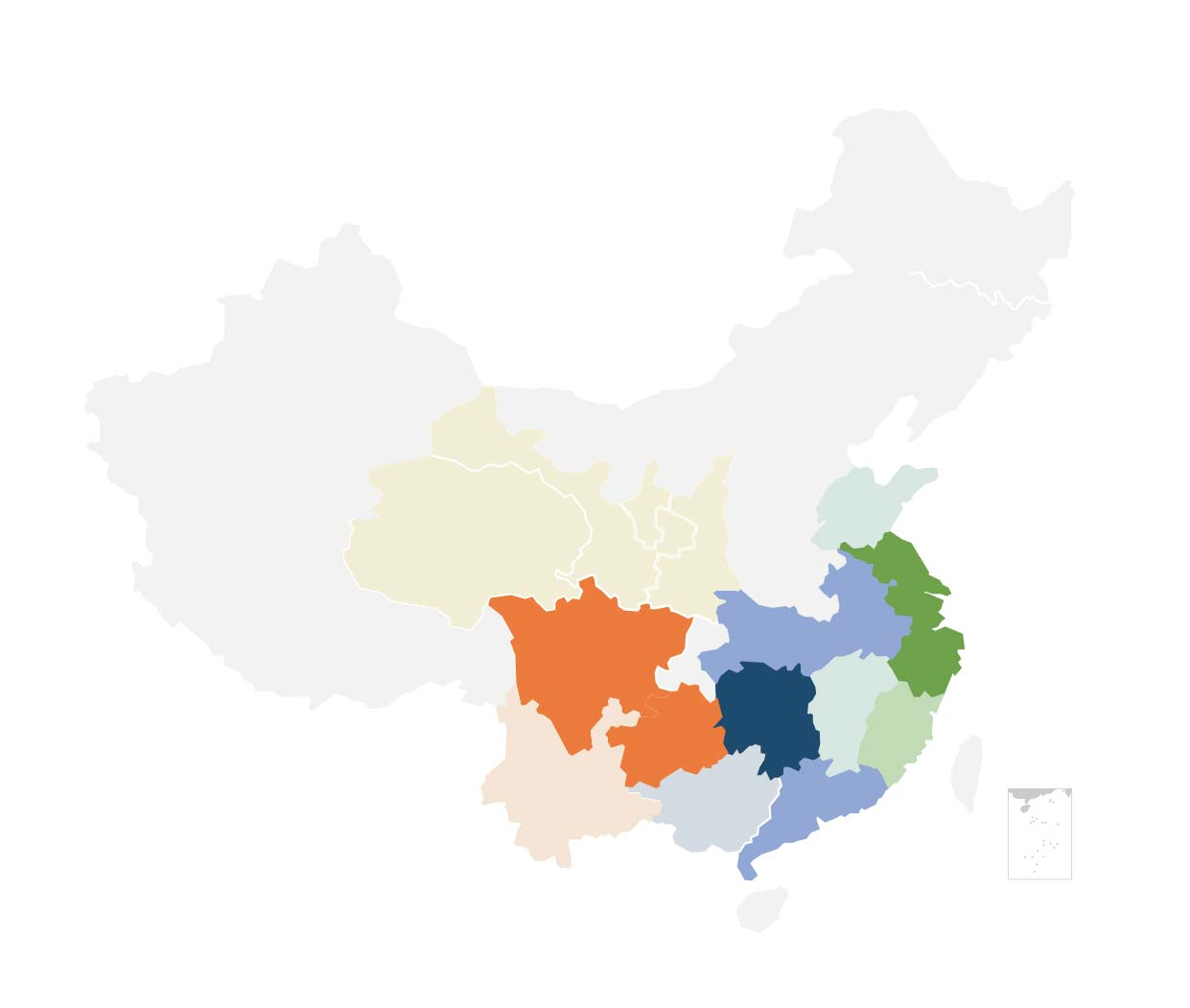

At present, the province with the largest production capacity of ternary materials is Hunan Province in central China. As one of the earliest areas in China to realize the industrialization of ternary materials, Hunan Province has a group of industry leaders, which has promoted the development of China's ternary materials industry. The existing production capacity in Hunan Province mainly comes from CHANGYUAN LICO (Lugu Factory, Tongguan Base Phase I and II, Changsha High-tech Zone Phase I), Shanshan (Lugu Factory, Ningxiang Factory, Changsha High-tech Zone Phase I) and so on. According to the enterprise plan, the production capacity of the existing ternary material projects in Hunan Province will reach 700,000 tons after all projects are put into operation, continuing to lead the way.

This is followed by Guizhou and Sichuan provinces in the southwest. In recent years, the southwest region has seized the development opportunities of the lithium battery industry and vigorously developed the lithium battery and its material industry. At present, the lithium battery industry in Guizhou Province and Sichuan Province is booming, and Top 10 power battery companies such as CATL, BYD, CALB, and SVOLT have been introduced, bringing the industry to take off. Among them, in terms of ternary materials, Guizhou Province has introduced leading companies such as ZHENHUA E-CHEM and RONBAY TECHNOLOGY. The existing production capacity mainly comes from ZHENHUA E-CHEM (Guizhou Shawen Factory Phase I and II, Yilong Factory Phase I and II), RONBAY TECHNOLOGY (Guizhou Factory) ), etc. The existing production capacity of ternary materials in Sichuan Province mainly comes from B&M (Chengdu factory) and so on.

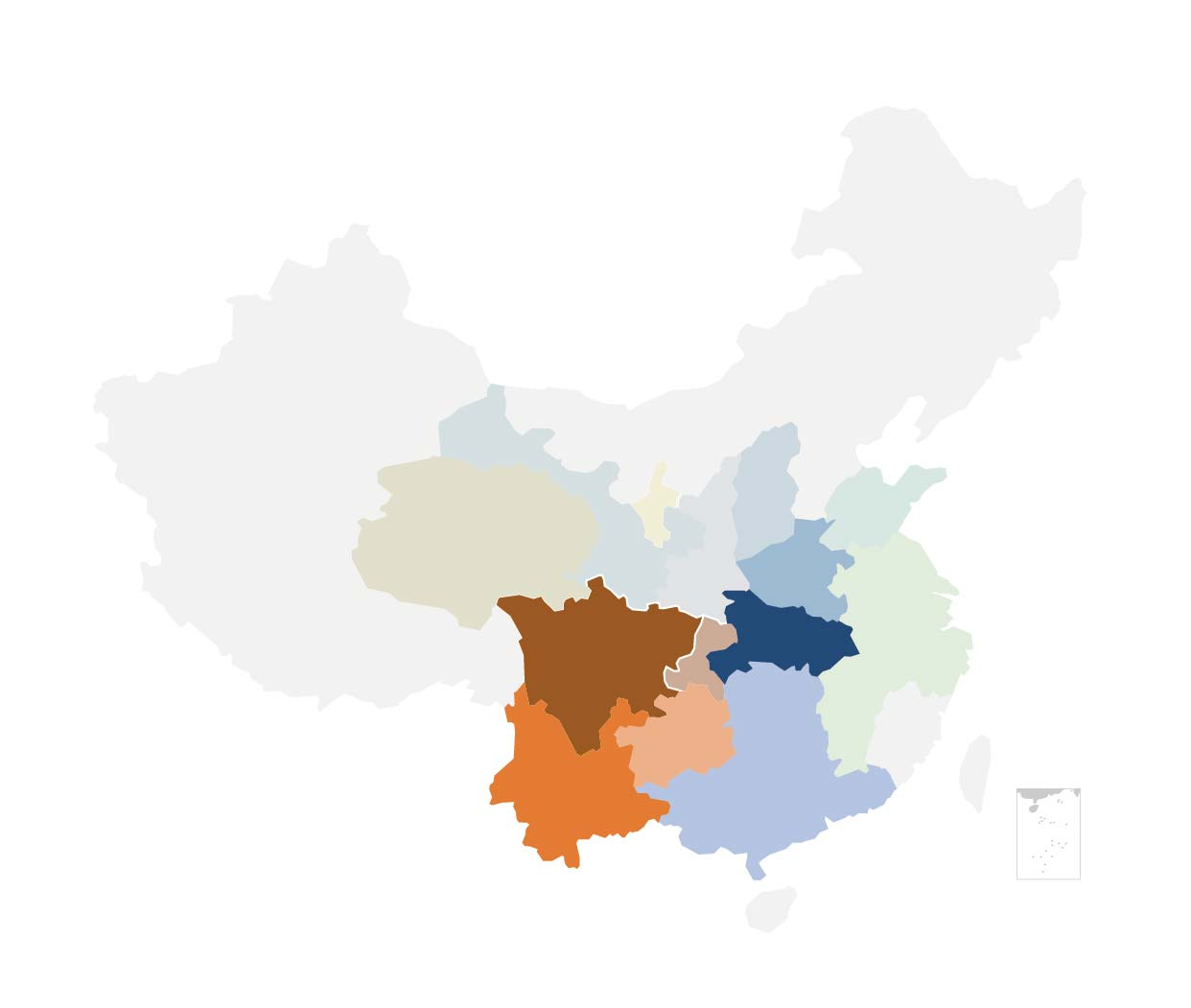

China's ternary cathode material production capacity distribution map

Note: The darker the color, the greater the existing capacity in the region, and the existing, under-construction and planned capacity in parentheses

Jiangsu Province and Zhejiang Province in East China are also the places where the production capacity of ternary cathode materials is concentrated. Jiangsu Province has RESHINE NEW MATERIAL, GEM, EASPRING MATERIAL TECHNOLOGY and other ternary cathode material companies, and the current production capacity is 100,000 tons. Zhejiang Province has ternary cathode material companies RONBAY, HUAYOU NEW ENERGY, etc., and now the production capacity is also at the level of 100,000 tons.

It is relatively easy to expand the production capacity of ternary cathode material companies. The expansion time of 10,000 tons of ternary cathode material (production line construction time) is about 1-1.5 years, and there is no core limiting factor for production capacity. In addition, ternary batteries are one of the confirmed trends in the new energy passenger vehicle market. The market demand for upstream ternary cathode materials will continue to increase in the future. In order to meet the needs of downstream battery companies, leading material companies will be more inclined to be closer to customers, Proximity to areas with lower resource or factor costs to expand production.

2.Lithium iron phosphate material

Lithium iron phosphate material is an inorganic compound, which belongs to the orthorhombic olivine structure, and is mainly used as a cathode material for lithium batteries. The raw materials of lithium iron phosphate materials are abundant and cheap, and do not contain heavy metal elements that are harmful to the human body. At the same time, the prepared battery has many advantages such as high safety and long cycle life, and currently occupies an absolute dominant position in the fields of new energy commercial vehicles, energy storage, and short- and medium-distance passenger vehicles.

In the past two years, as Tesla and BYD have successively released iron-lithium versions of Model 3, "Han", and the popular model Hongguang MINI, they are all equipped with lithium iron phosphate batteries, which has driven the market's attention to lithium iron phosphate batteries. high. Driven by downstream terminals, China's upstream lithium iron phosphate material companies have accelerated production expansion, and at the same time, many companies have entered the market, such as YUNNAN YUNTIANHUA, ZHTB, LOMONBILLIONS, LOPAL, etc.

Regional distribution of lithium iron phosphate cathode material production capacity in China in 2021 (unit: %)

Judging from the regional layout of the company's existing production capacity, the current production capacity of lithium iron phosphate is mainly concentrated in the southwest region, which is the gathering place of mineral resources such as phosphate ore, lithium ore, and manganese ore in my country. Superimposed favorable factors such as abundant green power resources, low factor costs, and perfect lithium battery industry chain, a group of lithium iron phosphate material companies have been gathered. Next is Central China, which is mainly contributed by Hubei Province. East China is mainly contributed by Jiangsu Province, Zhejiang Province and Anhui Province, and the existing production capacity of lithium iron phosphate materials in other South China, North China, and Northwest China ranks next in order.

The regions with the largest existing production capacity of lithium iron phosphate cathode materials are Hubei Province in Central China and Sichuan Province in Southwest China, and the combined production capacity of the two provinces accounts for more than 1/3. Among them, the existing production capacity of lithium iron phosphate cathode materials in Hubei Province mainly comes from WANRUN NEW ENERGY (Xiangyang factory), RT-HITECH (Daye I and II), and the existing production capacity of lithium iron phosphate cathode materials in Sichuan Province mainly comes from HUNAN YUNENG (Suining Phase 1, Phase 2, Phase 3, Phase 4), LOPAL (Phase 1 of Suining), etc. According to the company's production capacity planning, after the project is fully put into operation, the production capacity of lithium iron phosphate cathode materials in Hubei Province and Sichuan Province will reach 1.6 million tons and 1.2 million tons respectively, and will continue to rank in the top two in terms of production capacity of lithium iron phosphate cathode materials.

China's lithium iron phosphate cathode material production capacity distribution map

Note: The darker the color, the greater the existing capacity in the region, and the existing, under-construction and planned capacity in parentheses.

The second is Yunnan Province in the southwest. Thanks to the development of the lithium battery industry in the past two years, lithium iron phosphate cathode material companies have continued to invest/expand production. The existing production capacity mainly comes from LinTie Technology (joint venture with CATL), Qujing Dynanonic (joint venture with EVE), with Dynanonic and HUNAN YUNENG's Kunming Anning plant put into operation, and the YUNTIANHUA GROUP 500,000-ton lithium iron phosphate integrated project completed and put into operation, the production capacity of lithium iron phosphate cathode material in Yunnan Province will reach one million ton level.

The expansion cycle of lithium iron phosphate cathode materials is relatively short. Under the condition of mature technology, the expansion cycle is 6-10 months. With the increasing terminal demand for new energy vehicles and energy storage, lithium iron phosphate cathode material companies will continue to increase their own production capacity and invest in construction, and find suitable targets for investment and expansion.

2017-2022 China's lithium battery cathode material shipment structure (unit: %)

3. Lithium cobalt oxide material

Although lithium cobalt oxide and lithium manganate cathode materials will maintain a certain growth in the future, compared with ternary and lithium iron phosphate cathode materials, production capacity and production/expansion events are relatively small. Lithium cobalt oxide cathode material is the first-generation industrialized cathode material for lithium batteries, and it is also one of the most mature cathode materials for lithium batteries. Thanks to the high compaction density and volumetric energy density of lithium cobalt oxide cathode materials, it is widely used in small and medium-sized electronic products with high volumetric energy density requirements, such as mobile phones, earphones, and cameras.

The market share of lithium cobalt oxide cathode materials is highly concentrated, and the large-scale expansion of production capacity of companies is mainly concentrated in leading companies. Such as CHANGYUAN LICO and Shanshan in Hunan Province, ZHENHUA E-CHEM in Guizhou Province, XTC in Fujian Province, KH in Guangdong Province and B&M in Tianjin.

4. Lithium manganate material

Lithium manganate cathode materials are divided into two manganese type lithium manganate cathode materials and four manganese type lithium manganate cathode materials. At present, dimanganese type lithium manganate is the main shipping force. Dimanganic lithium manganate cathode material is also known as energy storage type lithium manganate cathode material. Because of its low cost, good rate performance and short cycle life, it is mainly used for electric two-wheelers with low cycle life requirements, automotive and digital lithium battery fields.

The tetramanganese-type lithium manganate cathode material is called the power-type lithium manganate cathode material. It is produced by manganese tetroxide and lithium carbonate. Mainly used in the field of base station energy storage, home energy storage and electric two-wheeled vehicles. Compared with other cathode materials, lithium manganate cathode materials have fewer investment/expansion events, mainly due to the overcapacity of lithium manganate cathode materials themselves.

In addition, the future demand growth in application fields such as downstream electric two-wheelers will be flat, and the profit of lithium manganate cathode materials is low and the market size is relatively small, and material companies are not enthusiastic about expanding production. The existing production capacity is mainly concentrated in Xinxiang Tianmao in Henan Province, SOUTH MANGANESE in Guangxi Autonomous Region, and WUXI JEWEL in Jiangsu Province.

Related article: Top 10 lithium battery companies, Top 10 lithium battery separator companies