The inverter is an important device in the photovoltaic power generation system. Its main function is to convert the direct current (DC) generated by the solar panels into alternating current (AC) to supply household, industrial and commercial uses.

Photovoltaic power generation systems usually consist of three major parts, namely solar panels (photovoltaic modules), controllers, and photovoltaic inverters. The photovoltaic inverter plays a core role in the entire photovoltaic power generation system. Now let’s take a look at the development trends in the inverter industry.

Main content:

1. The role of photovoltaic inverter

When sunlight hits a solar panel, the semiconductor material absorbs the light energy and converts it into electricity. The current generated by this process is direct current, however, the common power systems use alternating current.

The task of the inverter is to convert this direct current into alternating current suitable for the grid to ensure that the energy generated by the solar panels can be effectively transmitted to the grid. To get the best product, you can check the battery stores near me.

Photovoltaic inverter products are mainly divided into four categories: centralized inverters, distributed inverters, string inverters, and micro inverters. According to their different characteristics, they correspond to different application scenarios.

The core elements of differentiation mainly lie in the number of components corresponding to maximum power tracking and the size of the volume and weight. The comparison of inverters with different technical routes is as follows:

|

Comparison of inverters with different technical routes |

||||

|

Items |

Centralized inverter |

String inverter |

Distributed inverter |

Micro inverter |

|

Working principle |

After MPPT for multiple parallel photovoltaic strings, they are converted into AC and connected to the grid. |

After MPPT for multiple parallel photovoltaic strings, they are converted into AC and connected to the grid. |

Through multiple MPPT control optimizers in front, realize multi-channel MPPT optimization function. |

Perform MPPT on a single component and directly convert it into AC power. The converted AC power of each component is collected and integrated into the grid. |

|

DPPT number of components |

System level, larger number of strings |

Multiple string levels |

Single/multiple string levels |

Component level |

|

Common output power range |

Above 500kW |

1-320kW |

Above 1mW |

0.25-2kW |

|

Power generation efficiency |

Average |

High |

High |

Highest |

|

Inverter cost |

Low |

Low |

Low |

High |

|

Representative companies |

Sungrow Power |

Aiswei, Huawei, Ginlong, GoodWe |

Sineng |

Hoymiles、APsystems |

|

Main application scenarios |

Centralized power generation scenario |

Centralized and distributed power generation scenario (industrial and commercial, household use) |

Centralized and distributed large-scale power generation scenario |

Distributed power generation scenario (mainly household use) |

2. Current status of the inverter industry

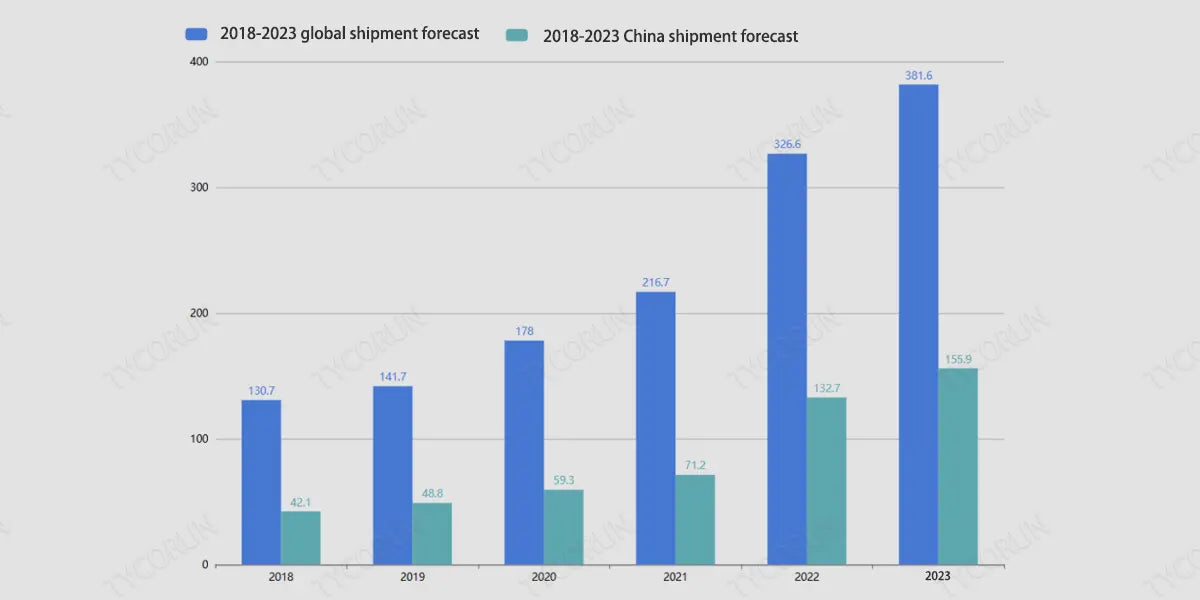

With the rapid development of the global photovoltaic inverter industry, as the core equipment of photovoltaic power generation systems, the market size of photovoltaic inverter industry is rapidly expanding. The global inverter industry market is in a state of rapid growth, with an obvious growth trend year by year.

Judging from shipments, total global photovoltaic inverter shipments will reach 326.6GW in 2022, an increase of 110.7GW from the previous year, with an annual growth rate of approximately 51.3%. Global photovoltaic inverter shipments have an obvious growth trend. According to forecasts, global photovoltaic inverter shipments are expected to reach 381.40GW in 2023.

The global inverter industry market size is expected to exceed 100 billion in 2023, with energy storage converters contributing the largest increase. In the context of the transformation of the global new energy structure, as the scale of the photovoltaic power generation market continues to expand and the demand for replacement of old equipment increases, the global inverter industry market shipments will further grow.

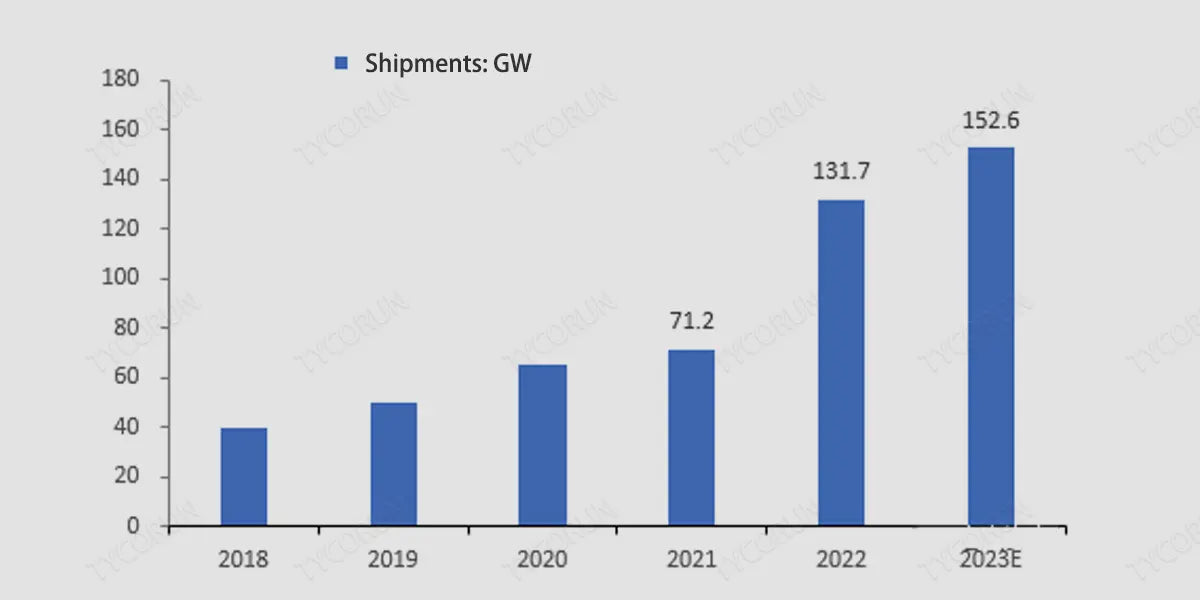

3. China’s photovoltaic inverter shipments

In China, the development of the photovoltaic inverter industry is strongly supported by the state and receives key support from national industrial policies. With the advancement of energy conservation and emission reduction policies, China's inverter industry is very prosperous, and the rate of scheduled expansion of Chinese inverter companies has increased significantly.

China's total photovoltaic inverter shipments reached 131.7GW in 2022, an increase of approximately 60GW from the previous year and an annual increase of approximately 85%. China's photovoltaic inverter shipments will continue to grow rapidly in the future, with total shipments predicted to reach 152.6GW in 2023.

4. Market share of different types of inverters

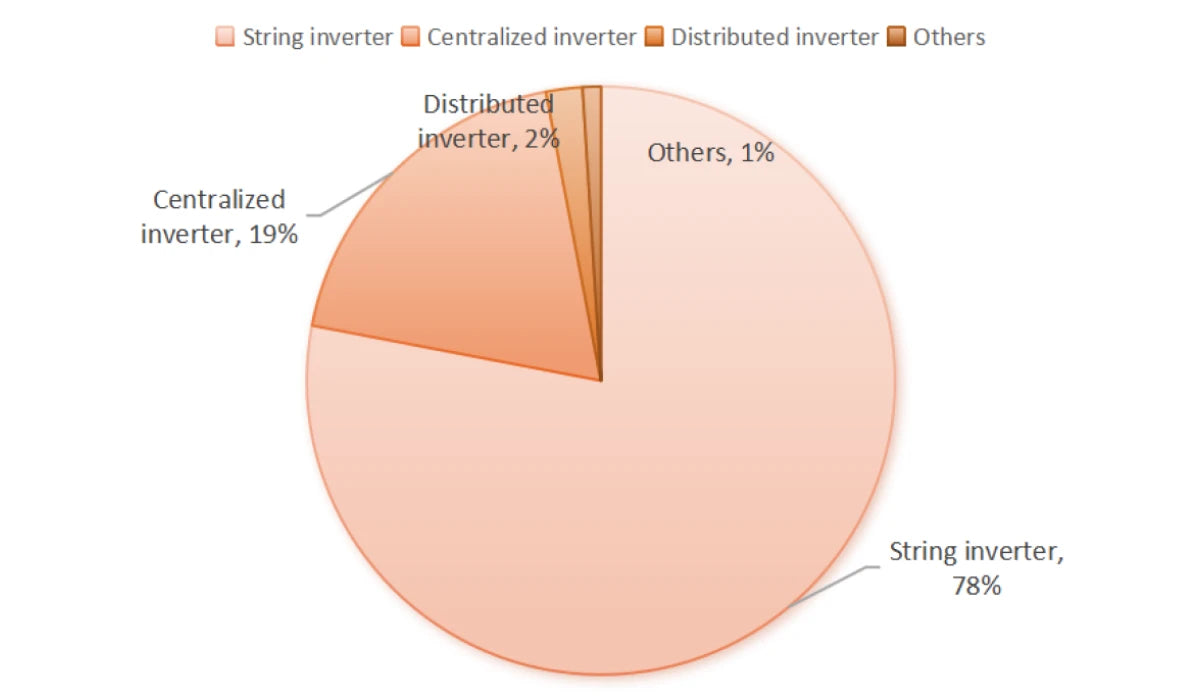

The current mainstream product in the photovoltaic inverter industry is string inverter. According to statistical data, the proportion of string inverters has gradually increased since 2016.

In 2018, the proportion of string inverters exceeded the proportion of centralized inverters. In 2021, the proportion of string inverters was close to 70%. In 2022, benefiting from The installed capacity of China's distributed inverter industry market has grown significantly, and the proportion of centralized and distributed inverters has further shrunk.

Among them, the proportion of string inverters has increased to more than 78%, while the proportion of centralized inverters was about 20%. String inverters have the characteristics of small unit capacity, high system efficiency, easy installation and maintenance, etc. They can be applied in centralized power stations, distributed power stations and rooftop power stations.

With the continuous advancement of technology and lfp battery, string inverters are becoming more and more popular and the cost of the device continues to decline, making its application areas continue to expand.

5. Competition landscape of inverter industry

As the scale of photovoltaic power generation continues to rise, the inverter industry is growing rapidly. The overall market structure of the photovoltaic inverter industry is characterized by a relatively concentrated headquarter, which mainly participates in differentiated competition among enterprises. The market share of Chinese companies in the inverter industry continues to increase.

Judging from the ranking of enterprise shipments, Chinese manufacturers account for six of the top ten inverter manufacturers in the world in 2020, including Huawei, Sungrow, Growatt, Ginlong, Sineng, GoodWe and Sofar solar. From the perspective of inverter industry concentration, the global photovoltaic inverter industry has many market participants and is a fully competitive market.

|

2022 Global photovoltaic inverter supplier shipment ranking |

|

|

Ranking |

Company name |

|

1 |

Sungrow |

|

2 |

Huawei |

|

3 |

Ginlong |

|

4 |

Growatt |

|

5 |

SMA |

|

6 |

Power Electronics |

|

7 |

SolarEdge |

|

8 |

Sineng |

|

9 |

GoodWe |

|

10 |

Sofar solar |

Operating characteristics of main companies in inverter industry

① Sungrow: A high-tech enterprise focusing on the research and development, production, sales and service of new energy power equipment such as solar energy, wind energy, energy storage, and power wheels battery.

② Huawei: A leading provider of communication technology and network energy solutions. It provides multi-scenario solutions in the photovoltaic field covering household, industrial and commercial, large ground power stations to battery energy storage systems and microgrids. Its products include string inverters, energy storage inverters, photovoltaic module controllers, photovoltaic management systems, etc.

③ Ginlong: Based on the new energy industry, it is a high-tech enterprise specializing in the research and development, production, sales and service of string inverters and the core equipment of photovoltaic power generation systems. It is the third largest inverter manufacturer in the world.

④ Sineng: The main business is the research and development, production and sales of power electronic equipment. At present, Sineng's main products include photovoltaic inverters, energy storage bidirectional converters and other products, and it provides integrated business of photovoltaic power generation systems and energy storage systems.

⑤ GoodWe: It has long been committed to the R&D, production and sales of new energy power equipment such as solar energy and energy storage. Its main business products include photovoltaic grid-connected inverters, photovoltaic energy storage inverters, energy storage batteries and household systems.

6. Future development direction of inverter industry

- Overseas expansion

Chinese companies will accelerate their overseas inverter industry market expansion. They have established overseas channels in the early stage and increased channel construction after 2018, gradually narrowing the gap with overseas markets. By using domestic raw materials and lowering R&D management salaries, these companies will provide more cost-effective products, such as 3000 watt solar inverter and 2000 watt inverter.

- String type replaces centralized type

String inverters will gradually replace centralized inverters. The price difference between string inverters and centralized inverters will be reduced to 2 cents/W, and due to its advantages in multiple power generation periods and MPPT power generation gain, it will bring about a 0.5% IRR improvement to the power station. In 2021, the proportion of string inverters in central and state-owned enterprise bidding has exceeded 80%.

- Growth in energy storage

Energy storage will become the second growth engine of the inverter industry. It is expected that by 2025, every 1GW of energy storage inverters will correspond to 2GWh of energy storage installed capacity, and the price of energy storage inverters will drop by 15% every year.

This means that by 2025, the energy storage inverter industry demand will reach 104GW, the market space will reach 64.9 billion, and the compound annual growth rate will reach 54%. Chinese companies already have advantages in efficiency and product coverage in the field of energy storage. With the support of policies, China's power generation side energy storage market will usher in an explosion.

- Competitive advantage

Chinese inverter manufacturers have a competitive advantage in the energy storage field. The technology of energy storage converters is similar to that of photovoltaic inverters. Production line switching only takes 1-2 weeks, and it is common to customers. Sales channels and brand reputation are still valid.

Existing customers prefer to choose the same brand as the photovoltaic inverter to obtain more convenient after-sales service.

You can check our Tycorun inverter products: car inverter 3000w, 2000 watt pure sine wave inverter, 1000w car inverter, 500 w power inverter

Related posts: Inverter batteries near me, Top 5 inverter battery companies, Energy storage inverter