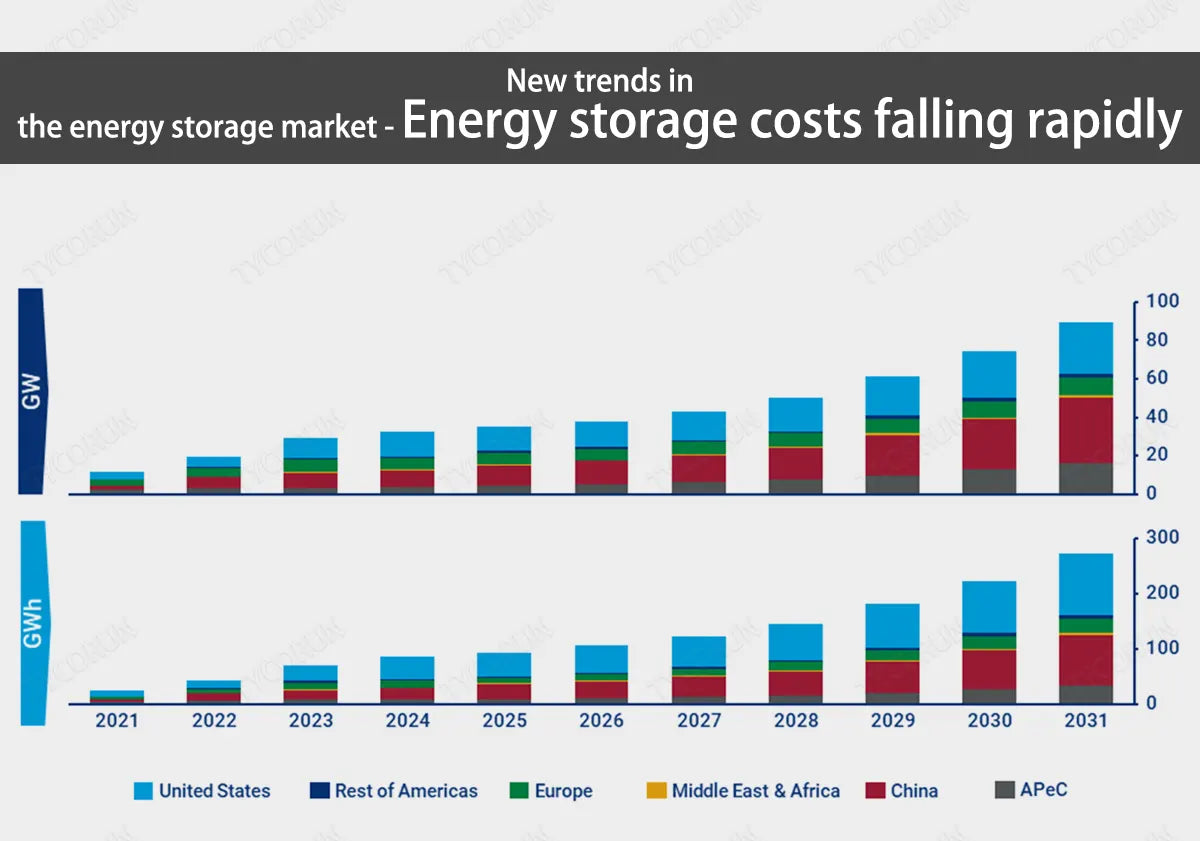

At present, the energy storage market has become a highly competitive market, but the market mechanism is still developing, the utilization rate of the energy storage projects is uneven, and the investment return period of energy storage projects is long.

In addition, especially compared with other alternative resources such as thermal power and pumped storage power stations, the cost of energy storage power stations themselves is still high, resulting in a high cost recovery period for energy storage projects. This problem is even more serious in the rapidly developing energy storage market.

Now there are widespread calls in the industry to promote the normalization of energy storage to participate in the power market, to form prices through market competition, thus continuously expand the benefits brought by electricity, and to provide more energy storage services. Precisely because of the multi-factor and uncertainty of energy storage costs, the topic about it always attracts the most attention in the industry.

According to statistics, many listed companies are targeting energy storage-related costs in mid-2023, including energy storage costs for lithium batteries, flow batteries and other technical routes such as power inverter 3000w and 2kw inverter.

Main content:

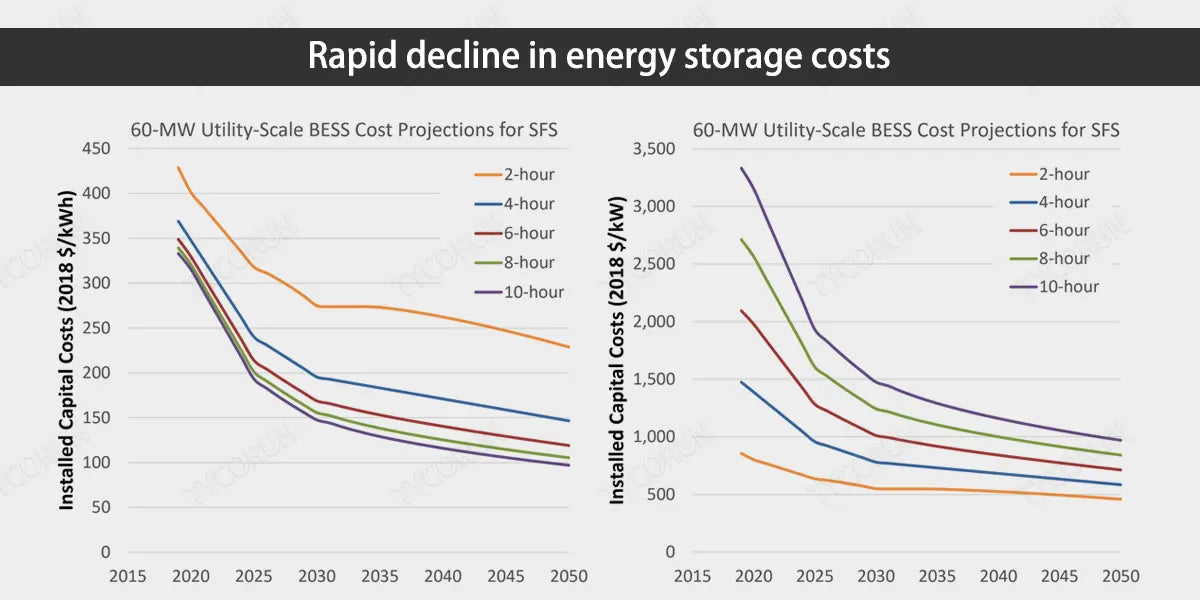

1. Rapid decline in energy storage costs

At the beginning of 2023, the unit price of energy storage system equipment was still hovering between 1.4-1.6 RMB/Wh. In September, the unit price fell below 0.9 RMB/Wh for the first time. Such changes are because of the fall in raw material prices upstream of the energy storage industry chain.

It is reported that An Hui Wenergy’s wind and solar installed capacity target is 4 million kilowatts, and it has currently obtained an indicator of over 1 million kilowatts (not yet finalized). The target for pumped-storage installations is to hold a controlling stake or participate in a project with a volume of 1.2 million kilowatts and above.

On February 17, in response to the topic of the economics of new energy distribution and storage and thermal power peaking projects, An Hui Wenergy stated that the current cost of energy storage is 1.5 to 2 RMB/Wh, followed by problems with call losses and battery replacement. The cost of energy storage is relatively high.

On April 24, CATL stated that electrochemical energy storage has more cost advantages when the material prices are appropriate, such as lithium batteries and sodium batteries. But this advantage gap has gradually narrowed, and other non-lithium battery energy storage technologies are booming.

On September 11, CGN New Energy’s 2023-2024 energy storage equipment framework centralized procurement bidding section 1 and section 2 were opened. The total bidding scale of the first and second sections was 1.25GWh. Among them, ZTT New Energy, the third winning bidder in the first section of the bid, had a bid unit price as low as 0.85 RMB/Wh, setting a record for the lowest bid for energy storage equipment that has been published.

On October 11, Three Gorges New Energy mentioned the cost of energy storage in its investor activity record, saying that the current construction cost of common LFP battery energy storage is about 1,000-1,500 RMB/kWh, and the construction cost of pumped hydro storage is about 4,500-7,000 RMB/kWh, the construction cost of compressed air energy storage is about 4,000-6,000 RMB/kW, and the construction cost of solar thermal power station is about 15,000-25,000 RMB/kW.

Zhenhua Co., Ltd. predicts that the cost of iron-chromium flow energy storage systems is expected to drop further, and the price of a 6-hour iron-chromium flow energy storage system can be reduced to 1,500 RMB/kWh. Its subsidiary company Zhenhua E-Chem also mentioned that as the entire supply chain of sodium power matures, sodium power still has a cost advantage when the price of lithium carbonate drops below 100,000 RMB/ton.

The all-vanadium redox flow battery energy storage system mainly includes stacks, electrolytes and other auxiliary equipment. At the end of September, Wintime Energy stated that based on the basic structure of the entire vanadium redox flow battery industry chain, the company is actively promoting the first phase of 3,000 tons/year high-purity vanadium pentoxide beneficiation and smelting production line and the first phase of 300MW/year.

The construction of a new generation of large-capacity all-vanadium redox flow battery and related product production lines has started at the end of June 2023 and is expected to be put into production in the second half of 2024. The depreciation life of fixed assets corresponding to energy storage equipment is about 20 to 25 years, and the residual value rate of a 4-hour energy storage system containing electrolyte is about 30% to 35%.

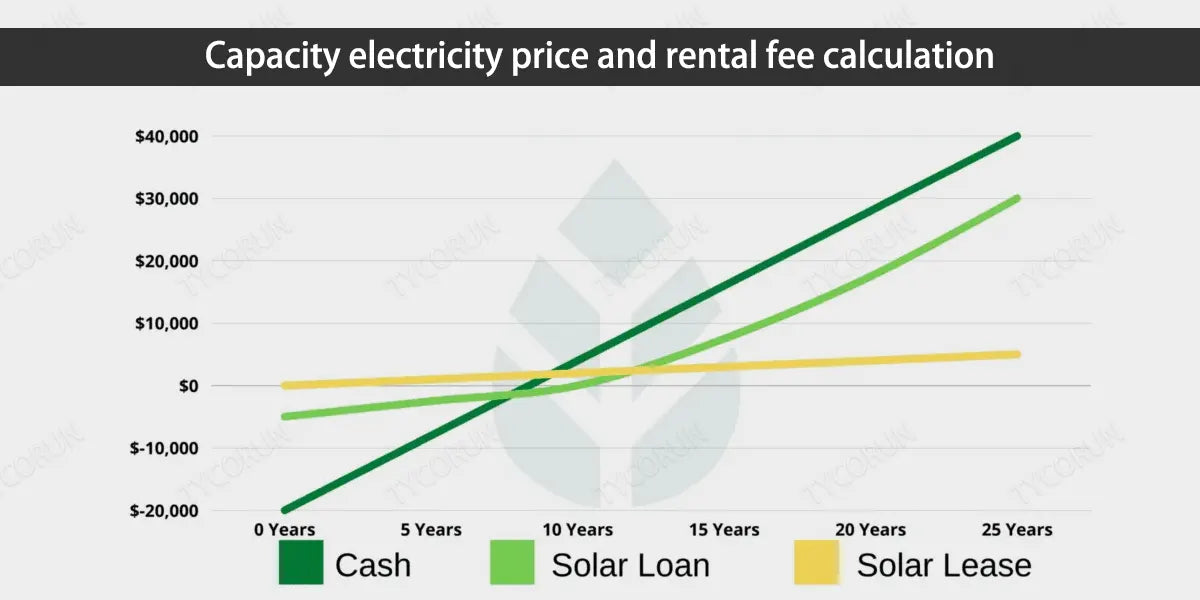

2. Capacity electricity price and rental fee calculation

Southern Power Grid Energy Storage pointed out in an institutional survey released on February 2 that the comprehensive construction cost of electrochemical energy storage stations (including supporting projects) is around 2.3-2.5 RMB/watt hour.

In addition, Southern Power Grid Energy Storage stated that from the company's practice, a new pumped-storage power station can achieve profitability in the year it is put into operation or the following year; the static payback period after all power stations are put into operation is about 15-20 years.

The capacity electricity price is determined based on various parameters such as a 40-year operating period, a 6.5% capital internal rate of return, total project investment, capital investment, loan interest rates, and operation and maintenance rates.

Southern Power Grid Energy Storage stated that the company has currently built several electrochemical energy storage power station demonstration projects. It refers to the electricity price mechanism of pumped storage power stations and calculates the capacity electricity price (lease fee) based on the internal rate of return of 5% of the capital throughout the life cycle of the project.

Southern Power Grid Energy Storage believes that energy storage revenue mechanisms that play different roles will also be different. In the future, marketization will generally be the main focus, forming a business model that combines multiple revenue models such as rental income, peak shaving, and ancillary services. The details will depend on the introduction of the new energy storage electricity price mechanism.

Data shows that in the first half of 2023, Southern Power Grid Energy Storage's gross profit margins for pumped storage, peaking hydropower, and new energy storage were 52.04%, 56.10%, and 26.78% respectively.

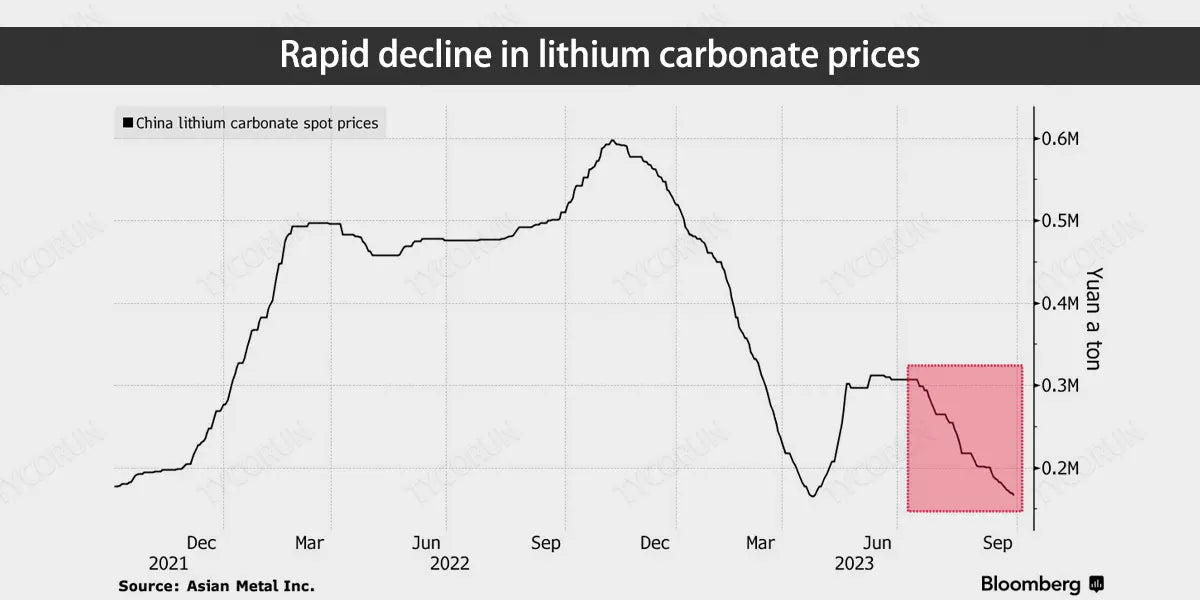

3. Rapid decline in lithium carbonate prices

From the energy storage cost operations of well-known companies in the energy storage industry mentioned above, we can see that energy storage costs have experienced a substantial decline this year, and the reasons behind the rapid decline in energy storage costs are, in addition to improvements in the integrated design technology of the energy storage system itself, the rapid decline in the price of lithium carbonate is another important reason.

As early as February 2023, the price of lithium carbonate was still at a high level. Some media reported that CATL planned to cooperate with a number of well-known car companies to implement a "Lithium Mine Rebate" plan to promote the decline of lithium carbonate prices through upstream and downstream linkage.

According to reports, the "Lithium Mine Rebate" program mainly targets CATL's strategic customers such as Lixiang, NIO, ZEEKR, Huawei, and Seres. Car companies that sign this agreement need to commit to providing 80% of their battery purchases to CATL, and CATL’s purchase price of part of the power wheels battery lithium carbonate in the next three years will be settled at 200,000 RMB/ton.

It is said that the latest quotation of lithium carbonate was about 431,000 RMB/ton at the time when the news came out. In less than two months, the price of lithium had fallen below 200,000 RMB/ton. Since 2023, the price of battery-grade lithium carbonate for battery stores near me has dropped more than 50%. As of recently, the quoted price of lithium carbonate has been as low as about 170,000 RMB/ton. Some industry insiders even believe that the price of lithium carbonate is expected to remain at 100,000 RMB/ton next year.

The rapid decline in costs has even exceeded expectations. Especially for companies engaged in the energy storage materials business, this year's income has been far dropped than last year.

Related posts: 12 volt 200ah lithium battery, golf cart battery, best batteries for solar off grid