Main content:

After a few months, the price of battery-grade lithium carbonate has returned to a high of 500,000 RMB/ton. The high price of battery-grade lithium carbonate has an increasingly prominent impact on upstream and downstream, and is also reshaping the entire industrial chain. The high prosperity of new energy vehicles continues.

Although listed companies continue to expand production, the contradiction between supply and demand of lithium carbonate is still difficult to solve in the short term, forcing industry chain companies to start doing their best. In order to get rid of the passive situation of lack of lithium resources and rising lithium prices, some of top 10 lithium battery companies and other mid- and downstream enterprises have begun to integrate their layouts, joining the upstream mining army and laying out downstream power battery recycling.

1. Will the price of lithium carbonate rise again?

The latest data shows that on September 13, battery-grade lithium carbonate rose by 2,600 RMB/ton, with an average price of 500,000 RMB/ton. This price is up nearly 8 times from the beginning of 2021 and nearly 80% from the beginning of this year. Lithium plants have been built and started one after another, and the market demand for lithium has increased. Under the background of high demand, listed companies are accelerating the expansion of lithium carbonate production capacity. Salt Lake Stock said that the company has now achieved a production capacity of 30,000 tons of lithium carbonate, and the self-built 40,000-ton basic lithium salt integration project has been implemented, and it is planned to be put into production in 2024.

The 30,000-ton battery-grade lithium carbonate project jointly developed by Salt Lake Stock and BYD is in progress. At the same time, GOTION HIGH-TECH is planning to build a 50,000-ton lithium carbonate project, and each is supporting a 7.5 million-ton lepidolite ore mining and processing project. In addition, Ganfeng Lithium, Zangge MINING, Tianqi Lithium and other related listed companies are actively expanding lithium carbonate production capacity. Database statistics show that in 2022, the world will add about 180,000 tons of lithium carbonate.

In 2023, the new global lithium carbonate production capacity will be about 400,000 tons. While supply is tight, demand is still increasing substantially. The rapid growth of new energy vehicles has driven the power battery industry to continue to be hot. Many market participants expect that sales of new energy vehicles will continue to hit a new high this year, which also means that both power batteries and lithium carbonate will be in high demand.

2. What should downstream battery factories do?

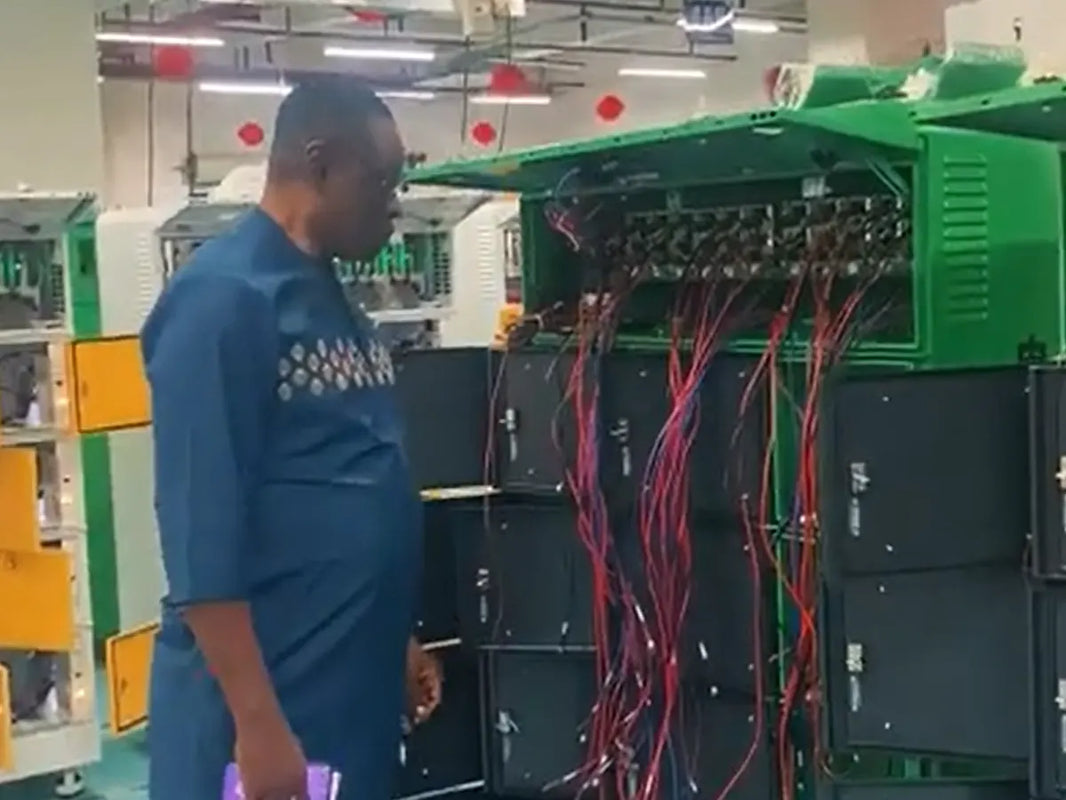

The rising price of lithium carbonate is changing the industrial structure of new energy vehicles and power batteries, and mastering upstream lithium resources has almost become an industry consensus. The upstream of the lithium battery industry chain is raw materials and lithium battery equipment, the midstream is lithium battery manufacturing, and the downstream is lithium battery applications. The new high price of lithium battery materials makes the industrial development show two extremes: profits are concentrated upstream, and pressure is transmitted downstream.

Judging from the data in the 2022 semi-annual report, Tianqi Lithium and Ganfeng Lithium, representing lithium salt-related listed companies, have more than doubled their net profits. The gross profit margin of power battery companies such as CATL and GOTION HIGH-TECH in top 10 power battery companies has fallen sharply. Among them, the operating cost of CATL's power battery system has increased by 186.78% year-on-year. As the most downstream car companies, they are in a state of loss. In the second half of the year, the terminal industry maintained a high degree of enthusiasm, and the progress of lithium iron phosphate production was progressing in an orderly manner.

The phenomenon of promoting the increase in demand for lithium carbonate products directly leads to the fact that the current social inventory is mainly concentrated in middlemen and downstream head factories, lithium carbonate suppliers have almost no spot inventory, and the price of new orders is strong. In the short term, the price of lithium carbonate is under pressure. Overall, the short-term price of lithium carbonate in China is expected to remain within a narrow range. On the whole, the price fluctuation of lithium battery materials affects the whole body in terms of the industrial chain. The supply of upstream lithium resources is the key to determining the future trend of lithium prices.

From the current point of view, the supply and demand gap superimposes the cost support to move upward, and there is still some room for lithium prices to rise. In view of this, integrated development enterprises with high resource self-sufficiency rate or accelerating improvement are generally favored by the industry. Professionals said that in order to cope with the rise in raw materials, OEMs have deeply entered the upstream and downstream of the battery industry chain, and some began to build their own batteries and invest in mining factories, which will also affect power battery companies.

For example, in order to lock in upstream resources and accelerate the integration of upstream and downstream, CATL has continuously deployed lithium carbonate projects in Yichun, Jiangxi. Previously, leading companies such as Ganfeng Lithium have already made arrangements here. The profits of the lithium battery industry chain are concentrated in the upstream lithium mine. In terms of cathode materials in the production process, although the current theoretical profit value is profitable, due to the limited acceptance of price increases by downstream battery factories, the actual transaction price is still low, and the profit margin of production enterprises is limited.

3. How can battery recycling break through?

As the price of lithium carbonate continues to rise, the power battery recycling industry has also become popular, and even caused the price to be inverted for a time. Power battery recycling is a post-cycle industry of lithium batteries, and the demand is expected to increase year by year due to the prosperity of the industry chain. From a long-term perspective, the industry is currently at the starting point of a long economic cycle. Under the expectation of high economic development, many listed companies have made arrangements in the field of power battery recycling. In 2015, CATL entered the field of power battery recycling.

In addition, BYD, Huayou Cobalt, Ganfeng Lithium and other listed companies have begun to deploy the power battery recycling industry. There are three mainstream business models in the current power battery recycling market: the model with battery manufacturers as the main body of recycling; the model with vehicle manufacturers as the main body of recycling; and the model with third parties as the main body of recycling. Favored by the market and favorable policies, the power battery recycling industry is booming. Since the beginning of this year, the social financing amount of battery recycling enterprises has increased significantly.

However, the problems emerging from the rapid development of the industry cannot be ignored. Top 10 power battery recycling companies have to face the problem of difficulty in making profits. At present, most companies' battery recycling business is not yet profitable. In many leading companies in the industry, battery recycling is not the main source of revenue, but only an auxiliary business. However, there is a huge market space for power battery recycling in the future. With the rising prices of lithium salt products represented by lithium carbonate and the unbalanced development of the industrial chain, it can be described as killing two birds with one stone.

Related articles: lithium battery recycling, carbon zinc battery vs alkaline